G2087

Medicare Basics

What you need to know about Medicare benefits and options.

Jeanne C. Murray, Extension Educator

Mary Ann Holland, Extension Educator

Mary E. Loftis, Extension Assistant

Nick Trede, Training Specialist, Senior Health Insurance Information Program

- What is Medicare?

- What is Medicare Part A?

- What is Medicare Part B?

- What is Medicare Part C?

- What is Medicare Part D?

- What is Medicare Supplement Insurance?

- Preventive Services

- Comparing Your Options

- Where to Go for Help

- Additional Information and Resources

|

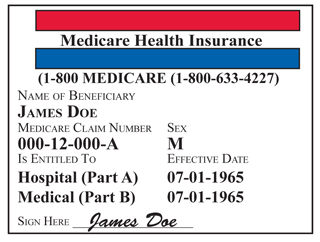

What is Medicare?

Medicare is health insurance for people age 65 or older, under age 65 with certain disabilities, and individuals at any age with end-stage renal disease (permanent kidney failure requiring dialysis or kidney transplant).

Medicare offers the following:

- Part A (hospital insurance)

- Part B (medical insurance)

- Part C (Medicare Advantage Plans)*

- Part D (prescription drug coverage)

*Part C is Medicare Parts A and B, and sometimes D, administered by private insurance.

What is Medicare Part A?

Medicare Part A covers 80 percent of inpatient care in hospitals. This includes critical access hospitals and skilled nursing facilities (not custodial or long-term care). It also helps cover some hospice and home health care. You must meet certain conditions to get these benefits.

People with Medicare Part A are responsible for paying a deductible for each covered service. These deductibles vary according to service and are subject to benefit periods.

Premium Cost: Medicare beneficiaries usually do not pay a monthly premium for Medicare Part A. This is because you or your spouse paid Medicare taxes while working 10 or more years. If you do not automatically get premium-free Part A, you may be able to buy it.

What is Medicare Part B?

Medicare Part B helps cover doctors’ visits, outpatient care, durable medical equipment (diabetes testing supplies, walker, cane) and some other medical services that Part A doesn’t cover. Part B helps pay for covered medical services when they are medically necessary. Part B also covers some preventive services. Medicare B will cover 80 percent of covered charges, after you meet a yearly deductible.

Premium Cost: Most people pay a standard Part B monthly premium. This amount can change every year. Individuals with an annual income more than $85,000 and married couples with an annual income more than $170,000 will pay a higher Part B premium.

What is Medicare Part C?

Medicare Part C is an alternative to Original Medicare. Medicare Part C is also referred to as Medicare Health Plans, or Medicare Advantage Plans. Medicare Advantage Plans are health plan options that are approved by Medicare and administered by private insurance companies. They are required to provide the same coverage as Original Medicare Part A (hospital) and Part B (medical), and must cover medically necessary services. Some plans offer extra benefits, such as dental and vision services (benefits not covered by Original Medicare), and many include Part D drug coverage.

The monthly premiums of Medicare Advantage Plans are generally lower than those of Medicare Supplement Policies. In turn, enrollees must pay co-payments for each Medicare-covered service which varies according to plan and the service provided.

Some Medicare Advantage Plans have networks, which mean you may have to see certain doctors or go to certain hospitals to get covered services. Even if your plan does not have a network, you may be responsible for higher out-of-pocket costs if your provider does not accept the plan. It is recommended that you contact all your healthcare providers to ensure they will accept the Medicare Advantage Plan you are considering before enrolling.

Premium Cost: Monthly premiums for Medicare Advantage Plans vary and all enrollees must continue to pay the Medicare Part B premium. For information on Medicare Advantage Plans in Nebraska, visit www.doi.ne.gov/shiip/medsup/medadv.pdf.

What is Medicare Part D?

Medicare offers prescription drug coverage, known as “Part D,” for everyone with Medicare. Enrollment in Part D is optional, but if you decide not to enroll when first eligible, you may pay a penalty if you join later. However, if you have prescription coverage that is at least as good as what Medicare offers, called “creditable coverage” from an employer, you will not be penalized when you enroll in a Medicare Part D prescription drug plan.

If you join a Medicare prescription drug plan, you are usually required to pay a monthly premium. Other out-of-pocket costs include co-payments, coinsurance and/or deductible, if any. Plans also include a gap in coverage, otherwise known as the “doughnut hole.” Not all drug plans may cover your specific combination of prescriptions, so it is important to compare your options carefully.

If you have limited income and assets, Social Security can help with your prescription costs. Apply online at www.socialsecurity.gov/prescriptionhelp or call your local Social Security office.

Premium Cost: Monthly Part D premiums vary according to plan. To compare plans, visit Medicare’s website at www.medicare.gov or call (800) 633-4227. Annually, from Oct. 15 to Dec. 7, a person can change, disenroll or enroll in a prescription drug plan.

What is Medicare Supplement Insurance?

A Medicare Supplement Insurance Policy is health insurance sold by private insurance companies to fill coverage gaps, the 20 percent not covered, in Medicare Parts A and B. Medicare Supplement Policies are also known as “Medigap” Insurance.

While Medicare pays most of your healthcare costs, Medicare Supplement Policies help pay your share (coinsurance, co-payments, or deductibles) of the costs of Medicare-covered services. Depending on the plan, the individual incurs little or no out-of-pocket costs after Medicare and the Medicare Supplement Policy pay the healthcare provider.

Companies can only sell you a “standardized” Medicare Supplement Policy. There are currently 10 standardized plans available — Plans A through L. (Note, Medicare Supplement “Plans” A-D; F, G; K-N are different than “Parts” A through D of Medicare.) The term “standardized” means that each particular Medicare Supplement Plan offers the same benefits, no matter which company sells it (i.e., a Plan F with one company is required to have the same coverage as a Plan F from another company). Generally, the only difference among Medicare Supplement Policies is the cost.

Premium Cost: Monthly premiums for Medicare Supplement Policies vary according to company, plan, and the consumer’s age. For information on companies selling Medicare Supplement Policies in Nebraska, as well as pricing data, visit www.doi.ne.gov/shiip/medsup/medsup.pdf on the web or call Nebraska Senior Health Insurance Program (SHIIP) at (800) 234-7119.

What if I continue to work after I enroll in Medicare?

More and more people continue to work after they become eligible for Medicare, age 65. If you have healthcare coverage from you or your spouse’s employer, you may be able to delay enrollment in Medicare Parts B and D in order to avoid paying unnecessary insurance premiums. It is almost always in your best interest to take Medicare Part A when first eligible, since most people do not pay a premium for Part A. It is important to talk with your benefits administrator to see how your employer coverage works with Medicare.

The Social Security Administration will determine who pays first, Medicare or your group coverage, as well as assist you in deciding whether or not to delay enrollment in Medicare Parts B and D. Contact Social Security at (800) 772-1213.

How does COBRA work with Medicare?

Consolidated Omnibus Budget Reconciliation Act (COBRA) is a continuation of group insurance coverage that an individual may buy for a limited period of time. Timing matters when both COBRA and Medicare are involved. If you begin Medicare coverage before you become eligible for COBRA, then that COBRA coverage must still be offered to you. However, if you become entitled to Medicare after you are on COBRA, your Medicare entitlement will end the COBRA coverage. Talk to your benefits administrator for more information.

How does the Nebraska CHIP work with Medicare?

The Nebraska Comprehensive Health Insurance Program (CHIP) was created by the Nebraska Legislature for individuals who do not have, or have been denied, health insurance. If you are enrolled in CHIP and become entitled to Medicare because of a disability (those under 65), you will continue to be eligible for CHIP coverage. If you are enrolled in CHIP and age into Medicare (turn 65), you will lose CHIP coverage. For more information, contact Blue Cross and Blue Shield of Nebraska, the CHIP administrator at (877) 348-4304 or visit www.nechip.com on the Web.

Preventive Services

To prevent or minimize health issues Medicare offers a “Welcome to Medicare” physical during the first year of enrollment in Part B, plus bone density, cardiovascular, colorectal cancer, diabetes, prostate and abdominal aortic aneurysm screenings, Pap, pelvic and breast exams, mammograms, flu, Hepatitis B and pneumonia shots, glaucoma test, and smoking cessation counseling. Many of these services are paid by Medicare. Medicare will determine the frequency of testing after the first test.

Comparing Your Options

There are many decisions to be made as you become eligible for Medicare. How much coverage do you want/need to have? How much money are you willing and able to pay in insurance premiums? What are your medication needs and expenses? Answering these kinds of questions will help you limit your options.

Once you have narrowed your choices, consider the financial responsibility of each option. Compare premiums, deductibles, out-of-pocket costs for medical services, as well as the cost of your prescription medications. Often times, writing out these details and comparing the costs associated with each option will help you choose a healthcare route that best meets your needs.

Where to Go for Help

For unbiased information and advice, seek a trusted professional with the University of Nebraska–Lincoln Extension. These volunteers, who have been trained by the Nebraska Senior Health Insurance Information Program (SHIIP), (800) 234-7119, to work with Medicare, are:

| Jeanne Murray, Alliance | (308) 762-5616 |

| Mary Ann Holland, Weeping Water | (402) 267-2205 |

| Mary Loftis, Tekamah | (402) 374-2929 |

| Cheryl Tickner, St. Paul | (308) 754-5422 |

| Sandy Preston, Concord | (402) 584-2234 |

| Sue Pearman, Thedford | (308) 645-2267 |

| Ann Fenton, Pierce | (402) 329-4821 |

| Nancy Frecks, Trenton | (308) 334-5666 |

| Sonya Glup, Fullerton | (308) 536-2691 |

| Eileen Krumbach, York | (402) 362-5508 |

| Ruth Vonderohe, Center | (402) 288-5611 |

| Deb Schroeder, West Point | (402) 372-6006 |

Additional Information and Resources

| Nebraska Department of Insurance — www.doi.ne.gov/shiip |

(800) 234-7119 |

| Medicare — www.medicare.gov www.medicare.gov/Publications www.mymedicare.gov |

(800) 633-4227 |

| Social Security — www.socialsecurity.gov |

(800) 772-1213 |

This publication has been peer reviewed.

Visit the University of Nebraska–Lincoln Extension Publications website for more publications.

Index: Safety & Health

Health Care

June 2011, Revised November 2011