G1744

Livestock Gross Margin Insurance for Swine

This NebGuide discusses Livestock Gross Margin Insurance for Swine, which provides protection against declines in hog finishing margins.

Rebecca M. Small, Graduate Research Assistant

Josie A. Waterbury, Graduate Research Assistant

Darrell R. Mark, Extension Livestock Marketing Specialist

- What is Livestock Gross Margin Insurance for Swine?

- Availability of LGM

- How Does LGM Work?

- What Does LGM Mean for Swine Producers?

- Conclusion

What is Livestock Gross Margin Insurance for Swine?

Livestock Gross Margin Insurance (LGM) for Swine is an insurance policy first offered in 2002 as a pilot program in Iowa through the USDA’s Risk Management Agency (RMA). The program was expanded to include several more states for the 2008 crop year that began July 2007. LGM provides protection against declines in livestock feeding margins (see NebGuide G1641, Livestock Gross Margin Insurance for Cattle, to learn about LGM for Cattle).

LGM Insurance for Swine creates margin protection by simultaneously hedging the input costs of corn and soybean meal and the market hog selling price as a bundled option. This insurance policy is available for farrow to finish operations, feeder pig finishing operations, and segregated early weaned (SEW) pig finishing operations.

Essentially, LGM pays insured producers an indemnity when the spread between the swine selling price and soybean meal and corn input prices narrow beyond their insured coverage level. As this feeding margin narrows, the corresponding indemnity payment becomes larger to offset lower revenues (through lower market hog prices) or increased costs (higher soybean meal and corn prices). The LGM for Swine insurance period consists of a six-month coverage period, allowing producers to insure target marketings (i.e., number of head intended to be sold that month) for any of the six months except the first month. So, when producers purchase LGM insurance, they can insure their expected marketings from two to six months in the future. Indemnity payments are based on a gross margin guarantee (GMG) and a total actual gross margin (AGM). The GMG is the swine finishing margin producers insure when they purchase the policy and is based on the expected gross margin, or EGM, that is calculated using expected swine, soybean meal and corn prices. These prices, as well as the actual prices that determine indemnities at the end of the insurance period, are based on the Chicago Mercantile Exchange (CME) lean hog futures contract and the Chicago Board of Trade (CBOT) corn and soybean meal futures contracts, respectively. The total AGM is the swine feeding margin that occurs due to realized, actual prices observed in the market after the six-month insurance period. At the end of the six-month insurance period, an indemnity is paid to the producer if the insured GMG for the six-month period exceeds the total AGM. The swine and corn prices used to compute the EGM and AGM are based on adjusted futures prices and state- and month-specific basis levels. Soybean meal prices used to compute the EGM and AGM are based only on futures prices with no basis adjustment. The basis adjustments for swine and corn prices are based on historical cash prices reported by the National Agricultural Statistics Service, not the spot basis that occurs in local markets during the insurance period. As a result, a basis between the LGM insured margin and the producer’s cash margin exists.

LGM is reinsured by the Federal Crop Insurance Corporation (FCIC). Although no producer premium subsidy is available for this insurance program, all administrative and policy expenses incurred by the crop insurance companies are paid by the federal government rather than insured producers.

While LGM is based on futures market prices and provides protection similar to a bundled option on futures contracts, producers using LGM take no futures or option positions themselves and therefore do not need a brokerage account. Its unique structure offers LGM several advantages over traditional options or futures. By allowing producers to sign up 12 times per year and insure all of the swine they expect to market over a six-month period, insured producers do not need to decide on the mix of options to purchase, the strike price of the options, or the date of entry into various option contracts. They also can purchase multiple policies and thereby insure just certain months of target marketings for additional flexibility. LGM also can be customized to fit the needs of any sized operation (within policy limitations), unlike futures and options contracts that cover fixed amounts of commodities. For example, one soybean meal contract equals 100 tons, one corn contract represents 5,000 bushels, and a lean hog contract is 40,000 pounds. The size of these contracts may not always lend themselves well to being used effectively in the risk management portfolios of smaller operations. In addition, the difficulty in using futures or options is compounded by the ratio producers would need to equalize lean hog, soybean meal and corn contracts according to production practices so as to not over- or under-hedge. The LGM policy removes these challenges and combines the three commodities in an equivalent fashion for producers so they do not have to purchase multiple contracts to be hedged in each commodity. Because there is no minimum number of head to insure with LGM, producers with smaller-sized operations can use LGM without hedging more swine than they plan to sell.

Availability of LGM

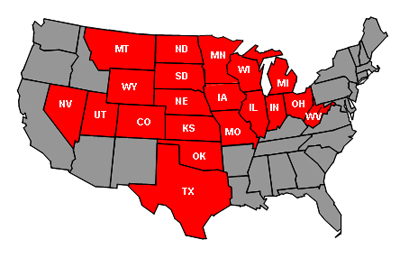

|

In order to insure swine with LGM, the insured swine must be located in one of 20 eligible states (Figure 1), although the owner does not necessarily have to reside in one of these 20 states. Additionally, the swine must be specifically intended for commercial or private slaughter. The owner of the swine also must have substantial beneficial interest (SBI) in the insured swine. In order to have SBI, the producer must have at least 10 percent ownership in the insured swine. The spouse of an insured individual automatically will have the same substantial beneficial interest as the insured, unless the spouse proves the swine insured are in a completely separate farming operation or the spouse derives no benefit from the insured farming operation. SBI is tracked in the LGM program because there are limits to the number of swine any one producer can insure.

LGM is available for purchase from any authorized crop insurance agent licensed to sell LGM. A list of authorized agents is available at http://www3.rma.usda.gov/apps/agents. If producers own swine in two different LGM eligible states, a separate LGM policy must be obtained in each state. As long as an insurance agent is licensed in both of the applicable states, the same agent can handle both policies.

LGM for Swine is sold one day prior to the last business day of every month so that the sales closing date for cattle and swine are not the same day (LGM for cattle has a sales closing date of the last business day of the month). The sales period commences once RMA validates the price data that is used to calculate the EGM. This verification of data occurs after the futures market closes on the last day of the price discovery period, which simply is the last three days of prices prior to the last business day of the month in the corresponding commodity months for lean hogs, soybean meal and corn. Recall that these three contracts are used to calculate the EGM for each of the target marketing months. For example, if the sales closing date for an insurance period is Feb. 27, expected prices would be determined using prices for the Feb. 25, 26 and 27 price discovery period. Thus, the LGM sales period begins after the futures market closes for the day and it ends at 9 a.m. CST on the next business day. RMA reserves the right to refuse the sale of LGM at any time. If EGMs are not posted on the RMA Web site on the second to last business day of a particular month, LGM for that insurance period is not available for purchase.

At the time of policy purchase, producers can elect to not insure a portion of their EGM by selecting a deductible between $0 and $20 per head in $2 per head increments. Like most insurance policies, an increase in the deductible decreases the premium. Premiums depend on a number of factors, including the level of coverage selected, a producer’s marketing plan (the number of swine insured in various target marketing months), the level of the futures prices, and the amount of price volatility. Because the premiums are based on actual market prices, the cost of LGM insurance and available coverage levels varies with each sales closing period. The premiums are determined through a statistical simulation and not by a simple step-by-step equation. Premiums and associated GMGs can be accessed from RMA’s Web site at http://www3.rma.usda.gov/apps/premcalc/.

The premium for the initial insurance period must be paid in full at the time the application is due, otherwise the application will not be accepted. The premium for all subsequent insurance periods must be fully paid by the applicable sales closing date for each policy. Otherwise, all target marketings will be reduced to zero for each month of the insurance period (that the premium is not paid), and a producer will have no coverage for any swine under that unpaid policy.

How Does LGM Work?

LGM has 12 different insurance periods, each operating on a six month cycle and each beginning after the sales closing date at the end of every calendar month. Coverage will begin one full month after the sales closing date, provided the premium for the policy has been paid in full. No swine marketings are insurable during the first month of any insurance period. For example, if a producer purchased a policy on the Jan. 30 sales closing date, no swine are insurable until March. The producer can insure target marketings from March through July with this policy. Producers can purchase one policy to cover the entire insurance period or obtain multiple policies with sales closing dates in different months. For example, producers wanting to insure swine from March to July could insure all five months with one policy (purchased at the end of January). Alternatively, they could purchase coverage for each month separately, buying March coverage in January or before, April coverage in February or before, and so on. Any combination of these two transactions also could be purchased. Insurance that is purchased on more deferred months generally receives the most protection against changing margins because future input price changes are hedged in addition to swine sales.

After a policy has been established, a producer must specify the target marketings under the policy for each month of the insurance period. Target marketings represent the expected number of slaughter-ready swine to be insured for that specific insurance period. These target marketings must not exceed a producer’s approved target marketings. Approved target marketings are the maximum number of swine that can be stated as target marketings on the insurance application and are based on the lesser of farm capacity or underwriting capacity for the insurance period as determined by the insurance company. Certified by the producer, approved target marketings are subject to inspection by the insurance agent in order to verify the marketings. All records relating to the breeding, farrowing, feeding, finishing and sale of the swine, as well as an examination of the swine themselves, are subject to inspection. Producers must retain all records for three years after the six-month insurance period has ended. These records include, but are not limited to, purchase, feeding, shipment, sale or other documents of transfers of all swine insured and not insured.

Producers are not required to insure all swine they plan to sell during the insurance period. A single producer has no limit to the number of LGM policies that can be purchased, but is limited to insuring less than 15,000 head for any six-month insurance period and 30,000 head per crop year (July 1 to June 30). Producers are allowed to insure all three types of operations (i.e. farrow to finish, feeder pig finishing and SEW pig finishing operations) at the same time as long as the number of head insured does not exceed the program maximum. However, AGMs, GMGs and indemnities are computed individually for each operation due to the differences in feed consumption and cost assumed for each operation.

The LGM for Swine policy does not protect against death loss, poor performance or any physical damage or loss. Any death loss that does occur does not need to be reported to the insurance agent. If total actual marketings are less than 75 percent of the total expected and insured target marketings for the six-month insurance period, the producer’s indemnity will be reduced by the percentage by which the total actual marketings for the insurance period fall below the total target marketings for the period; however, the premium will not be reduced. For example, if a producer insures 500 head of swine to be marketed during a six-month insurance period, but only is able to report sale receipts for 350 head due to a large death loss, only 70 percent of the insured target marketings were sold. This in turn reduces any indemnity the producer would receive by 30 percent. This adjustment to the indemnity is for the entire six-month insurance period, not individual target marketing months. However, if that same producer had marketed at least 75 percent of the marketings during the six-month insurance period (even though some death loss does occur), the insurance coverage remains unchanged and indemnities are not reduced. Returning to the previous example with 500 head being marketed, if the producer actually sold 400 head (80 percent of target marketings), the insurance coverage and any indemnities are still determined as though the producer marketed 500 head in the insurance period.

As mentioned earlier, three different types of operations are insurable with LGM for Swine. A farrow to finish operation assumes that pigs will be marketed at 250 lbs (live weight basis) and consume 13.86 bu of corn and 196.16 lbs of soybean meal per head. Feeder pig finishing and SEW pig finishing operations are also assumed to finish swine to 250 lbs (live weight basis). In the feeder pig finishing operation, hogs are assumed to eat 9.6 bu of corn and 132 lbs of soybean meal per head. The SEW pig finishing operation assumes that each hog consumes 9.7 bu of corn and 142 lbs of soybean meal. The finished weight for market swine are based on industry averages. Iowa State University’s optimal feed ration was used in determining feed quantities for each type of operation. It generally does not matter if actual feed consumption or animal performance differs from that above. However, to the extent these factors can change marketing dates, consideration should be given to whether actual marketings for an insurance period could drop below the 75 percent threshold.

At the time of coverage purchase, an expected gross margin (EGM) per head is calculated for each target marketing month using one of the equations below according to the type of operation. Note that there is a yield factor of 0.74 included in the EGM calculations to convert the CME lean hog futures price to a live hog equivalent price. The EGM per head for month t is calculated using one of the following equations:

Farrow to Finish

| EGMt = | [2.5 (cwt) × Swine Pricet ($/cwt) × 0.74] – [ (196.16 (lbs) / 2000 (lbs/ton)) × Soybean Meal Pricet-3 ($/ton)] – [13.86 (bu) × Corn Pricet-3 ($/bu)] |

Feeder Pig Finishing

| EGMt = | [2.5 (cwt) × Swine Pricet ($/cwt) × 0.74]

– [(132 (lbs) / 2000 (lbs/ton)) × Soybean Meal Pricet-2 ($/ton)] – [9.6 (bu) × Corn Pricet-2 ($/bu)] |

SEW Pig Finishing

| EGMt = | [2.5 (cwt) × Swine Pricet ($/cwt) × 0.74]

– [(142 (lbs) / 2000 (lbs/ton)) × Soybean Meal Pricet-2 ($/ton)] – [9.7 (bu) × Corn Pricet-2 ($/bu)] |

The EGM for each type of operation is calculated and available on RMA’s Web site at http://www3.rma.usda.gov/apps/livestock_reports/. Upon entering the calculation Web site, the year and state in which swine will be insured as well as the commodity (swine) must be selected. The report will then be created, stating the EGM for all target marketing months in available insurance periods as of the date the report was created. The actual gross margin (AGM) also will be shown for past target marketing months in which actual swine, soybean meal and corn prices are known. The AGM per head is based on the three respective commodity prices and is calculated with the same equation used to calculate the EGM. It is important to remember that the swine and corn prices include a fixed basis that does not differ between the EGM and AGM calculation. State- and month-specific basis for market hogs and corn can be obtained at http://www2.rma.usda.gov/policies/2008/lgm/08LGMSwineCEE.pdf.

Once all EGMs are calculated for each of the six target marketing months, all monthly EGMs are multiplied by their respective target marketings. These monthly totals (some of which may be zero if no target marketings are specified for that month) are then summed to create the total EGM. The GMG is then calculated by subtracting the total deductible (per head deductible times the total number of swine to be marketed) from the total EGM. Once the total AGM has been calculated (which occurs at the end of the six-month insurance period), an indemnity will be paid if the GMG is higher than the total AGM. Indemnities are not paid until the end of the six-month insurance period. In the event that an indemnity is due, the insurance company will issue a notice of probable loss. Within 15 days of receipt of this notice, the producer must then submit a marketings report and sales receipts to document that the swine were actually marketed and sold in order to receive the indemnity payment.

The principle behind LGM is to protect producers from a narrowing swine feeding margin caused by lower revenues and/or increased costs. If, for example, producers purchased this policy in January, they may receive an indemnity if swine prices decreased in later months or corn and/or soybean meal prices increased (or some combination thereof). It should be noted that the futures contracts which are the bases for determining EGM and AGM are sometimes not expired when determining the EGM, so swine, corn and soybean meal prices may be different for both the EGM and AGM calculations.

To illustrate, assume a farrow to finish operation bought LGM insurance on Jan. 30, 2007, for the May target marketing month. The LGM adjusted lean hog price as of Jan. 30, 2007, was $74.30/cwt (based on the May 2007 CME futures contract and fixed basis). The LGM adjusted soybean meal price as of Jan. 30, 2007, was $197.40/ton for February 2007 (a price based on the expired January and unexpired March 2007 CBOT futures contracts). The LGM adjusted corn price for February 2007 as of Jan. 30, 2007, was $3.71/bu (based on the expired December 2006 and unexpired March 2007 futures contracts plus the fixed basis). Thus, using the equation above, the EGM and GMG for the month is $66.67/cwt for one head (assuming no deductible). Suppose that the adjusted lean hog price subsequently dropped to $73.08/cwt in May when the swine are to be marketed (based on the expired May 2007 futures contract and the fixed basis). Suppose also that the adjusted soybean meal price increased to $202.50/ton (based on the expired December 2006 and now expired March 2007 futures contracts) and the adjusted corn price remained unchanged at $3.71/bu (based on the expired January and now expired March 2007 futures contracts and the fixed basis). Thus, the AGM for May would be $63.92/cwt. The AGM is subtracted from the GMG to give an indemnity of $2.75 per head. This is the indemnity that would be paid to the producer.

Sometimes the corn and soybean meal prices are not a factor in determining a margin change due to the way they are determined in the gross margin calculation. If the futures contracts these prices are based on are expired when determining the EGM, corn and soybean meal prices may be the same for both the EGM and AGM calculations.

Consider a feeder pig finishing operation with a sales closing date of March 29, 2007, the second to last business day of the month. The EGM and AGM for a May target marketing month would use the same futures contract prices for corn and soybean meal since the March 2007 corn and soybean meal contracts have expired. Therefore, the only difference in the EGM and AGM would be due to a change in the May 2007 lean hog futures price from March to the contract’s expiration in May. The LGM adjusted lean hog price on March 29, 2007, for a May target marketing month was $72.71/cwt (based on the May 2007 futures contract and fixed basis). The adjusted soybean meal price was $217.07/ton (based on the expired March 2007 futures contract) and the adjusted corn price was $3.85/bu (based on the expired March 2007 futures contract and fixed basis), producing a GMG of $83.23/cwt (assuming a $0 per head deductible). Again, because the futures contracts used to determine the soybean meal and corn prices were already expired, their prices will not change and not drive changes between the GMG and AGM.

What Does LGM Mean for Swine Producers?

Although LGM does not create a new marketing opportunity or a positive margin other than what the market actually offers, LGM does offer useful risk protection by hedging the gross feeding margin. This policy acts as a bundled set of options, protecting against adverse changes in the spread between lean hog, soybean meal and corn prices. Even though price risk is reduced with this coverage, it does not completely eliminate it nor does it address other types of risks associated with finishing swine.

Often, producers choose not to hedge swine, soybean meal and corn prices due to a lack of understanding the futures and options market. Furthermore, the contracts offered in these markets are sometimes difficult to utilize effectively because of their fixed contract sizes that are not adaptable to various operations’ sizes or needs. By not using futures and options or other marketing contracts, producers can be unprotected from price risk. LGM is an insurance product that allows livestock feeders to access the benefits of the futures market without some of the limitations imposed by the size of the specific contracts. Although LGM works to minimize margin risk, it still has limitations as it does not protect against basis risk or production and performance risk.

The risk of changes between actual basis levels and the fixed basis in LGM leaves swine feeders partially exposed to cash margin price risk. The prices used to calculate the expected and actual gross margins are not the same as the cash prices producers will realize in their own local swine, soybean meal and corn markets. Even though each policy uses a state- and month-specific basis for swine and corn, these basis adjustments are determined using the historical difference between the futures market price and the local cash price, not the current spot market basis during the insurance period.

Another issue to consider is the cash sale date of the swine. LGM has a specific ending date when the indemnity is determined and therefore cannot be offset earlier or later to capture its value. Although it may be favorable to sell the swine before or after the sales closing date, doing so creates some price risk. If prices are below coverage levels at the time of the cash sale, producers will receive a lower cash price, but the indemnity is still determined on the original end date of the insurance policy. Prices could then rise between the time of the cash sale and the end date of the policy, resulting in a smaller indemnity or no indemnity at all. Essentially, producers are exposed to price risk when the actual cash sale dates do not match the ending date of target marketing months and should be cautious when selling livestock at a time other than the target marketing month. Also be aware that an individual marketing day within the target marketing month could similarly result in different prices as well.

Conclusion

LGM provides swine producers with a price risk management tool by protecting against declines in the swine feeding margin. Expected and actual gross margins combine to provide producers with an indemnity if lean hog sale prices drop or major feed input costs rise. LGM offers an opportunity to combine the risk protection needed for lean hogs, soybean meal and corn commodities into one policy, so it is more convenient and can be tailored to meet the needs of small and medium sized operations. Although this program does not eliminate price risk directly, it does reduce the risk of volatile market differences in hog and feed prices. While LGM does not address production risk, it can be a useful tool as one component of a larger risk management program.

This publication has been peer-reviewed.

Visit the University of Nebraska–Lincoln Extension Publications Web site for more publications.

Index: Swine

Marketing

Issued July 2007