G1789

Planning and Tracking Income and Expenses Through Time: Cash Flow Planning

This publications explains the process of cash flow planning for household living expenses.

Kathy Prochaska-Cue, Extension Family Economist

- Shifting an Expense to Balance the Columns on the Cash Flow Worksheet

- Using the Cash Flow Planning Worksheet to Track Expenses

Most people have developed and tried to live with a budget. And for some, budgeting is a process that works. But as time goes on, even true-blue budgeters start to drop out of the process, saying it doesn’t work for them.

There is another process besides budgeting for planning and tracking income and expenses through time. That process — cash flow planning — may be more appropriate for some people than the traditional budget. The big difference is that a cash flow plan shows the timing as well as the source and amount of both income and expenses. It tracks when a major expense will happen, when credit will be needed, and when money will be available to use for future expenses. In other words, a cash flow plan identifies when money flows into the plan (income) and when it flows out (expenses).

Another advantage cash flow planning has over other tracking methods is that it is more realistic for many people since it does not use an arbitrary time period such as a month but uses actual timing of income to set a time period for a plan. For people who receive at least some of their income more than monthly or if the amount of income received varies, cash flow planning will be more realistic because it is based on the timing of income and expenses, not how much is received in a specified amount of time such as a month that is important.

To make a cash flow plan, follow these steps to complete the cash flow plan in this publication:

Step 1. Write your name in the blank on the top of the cash flow plan. You also might want to add the date when you did this plan.

Step 2. List income with anticipated days it will be received in the first column of the cash flow plan. Remember income includes all anticipated gifts and other assistance expected. Use take-home pay figures for income to make it easier to work with your plan.

Step 3. Determine planning time periods. Which income is received most often? The dates when that income source is received become the first day of each planning period. The last day of each planning period will be the day before the next time the most frequent income is received.

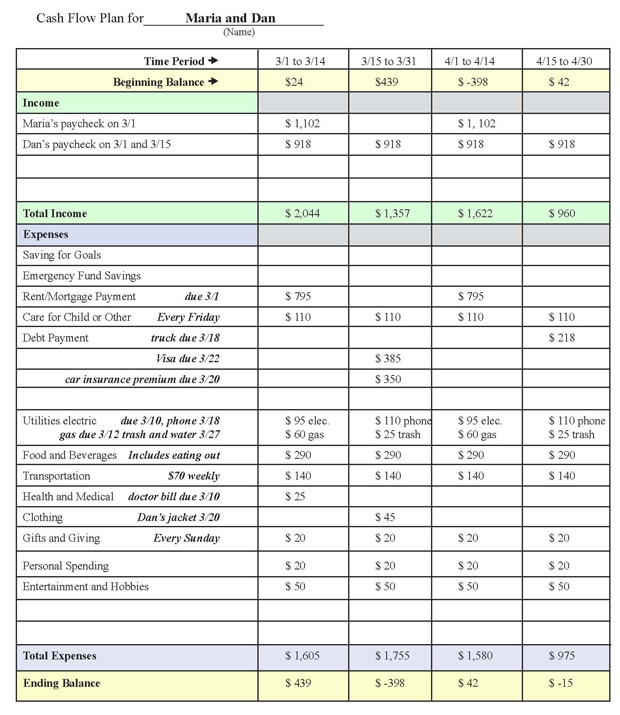

Example: Dan and Maria in the following example have two income sources, one received monthly on March 1, and the second income received twice a month on March 1 and March 15. Their second income source is received most often. So their first planning period becomes March 1 to March 14. The second planning period will be March 15 to March 31.

Step 4. Decide what expense categories you will use. Some common expense categories already are listed on the cash flow plan. If any of these expenses is not important for your plan, cross it out and you have another line for another expense category you need.

Write down any additional categories you want to have in your plan, perhaps an expense category you think you need to pay special attention to, such as eating out.

Do leave in the two savings categories: Savings for Goals and Emergency Fund Savings. Even if you don’t use them now, having them in your plan will remind you to try harder to find money for goals and emergencies.

Step 5. List all expected income and expenses by category and by amount in the appropriate planning column when each will occur. To make this easier, write down only the dollars but not the cents from every figure.

For example, if the number you want to write down is $75.10, just write down $75. If it’s 50 cents or more, go up to the next dollar. So $75.60 becomes $76.

Not sure what the amount of an expense will be? Go back to any past records you might have such as previous bills or receipts for utilities, insurance premiums and debt payments. Use information in your checkbook to help you develop a figure for groceries, car expenses, entertainment and clothing. Keep track of what you pay with cash for two or three weeks. Think about what needs to be purchased during each time period. Add any needs not covered by your current expense categories to the plan. For example, if you have children, in August you know you will need to add school expenses to your cash flow plan.

Step 6. Balance each planning time period column. Add all income sources. Write total income in the space provided. Do the same for expenses. Subtract expenses from income. Write that number in the ending balance space, the last line at the bottom of each planning column.

The goal is to have either a zero or a positive ending balance. If there is a negative ending balance, you must find more income and/or cut expenses for that planning time period.

Transfer the ending balance number plus any cash left at the end of the planning period to the beginning balance line for the next planning period, the first line of the next column. If the beginning balance number is a positive number, add it to all sources of income to get the total income available for that planning time period. If the beginning balance figure is a negative number, subtract it from all of the other sources of income for the total income for that planning time period.

An example of the first draft of a cash flow plan is on the next page. Dan and Maria are both employed. Their daughter, Anna, is 18 months old. They have added an expense category to their cash flow plan since the car insurance premium is due this month.

With their cash flow plan, Maria and Dan know they can’t spend the $439 left at the end of the first planning period. Even with that extra money, the second and fourth columns come up short.

So, what can Dan and Maria do when the columns of their cash flow don’t balance? There are only two things to do:

- Find more income and resources. Working overtime, visiting the food pantry or having garage sales are examples of finding more income and resources.

- Cut expenses. It’s easier to cut a little from several expenses than entirely cutting out something. To decide what to cut, Dan and Maria need to ask “What do we really need to spend money for now?”

They also may need to change the due date of, or at least pay, some of their fixed expenses from the last two weeks of the month during the first two weeks. They also could pay the vehicle insurance bill monthly to avoid having such a large bill every six months.

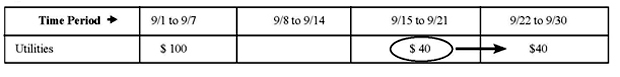

Shifting an Expense to Balance the Columns on the Cash Flow Worksheet

Another way to balance the planning columns is to shift an expense to the next column. While shifting an expense captures what people often do when short of money, exercise caution with this method. Always remember that a shifted expense still must be paid.

Consider the potential consequences of shifting an expense. What might happen if an expense if shifted? For example, if you decide to shift the electric bill until the next time period when it is past due, the electricity might be turned off.

Example: Alexi decides to balance her second planning column by shifting the $40 utility payment due to the next planning period. She indicates this shift as shown in Figure 1.

If shift an expense is shifted, remember to re-balance that column as well as all future columns in the plan until all columns end with a zero or a positive amount.

|

| Figure 1. |

Using the Cash Flow Planning Worksheet to Track Expenses

Another advantage of using a cash flow plan is tracking actual income and expenses right on the worksheet by writing down the actual amounts when they actually happen.

To make things easier, use a pencil to write all planning figures. When you actually receive income or spend money, erase the planning figure and write down the actual amount in ink. Always rebalance your entire plan if an actual figure differs from the planned number. Even easier is to set up the cash flow plan on a computer spreadsheet program so the worksheet is rebalanced each time changes are made.

By using a cash flow plan for both planning and tracking expenses, at a glance you’ll know:

- what has been paid

- what still needs to be paid

- if you’re on track financially

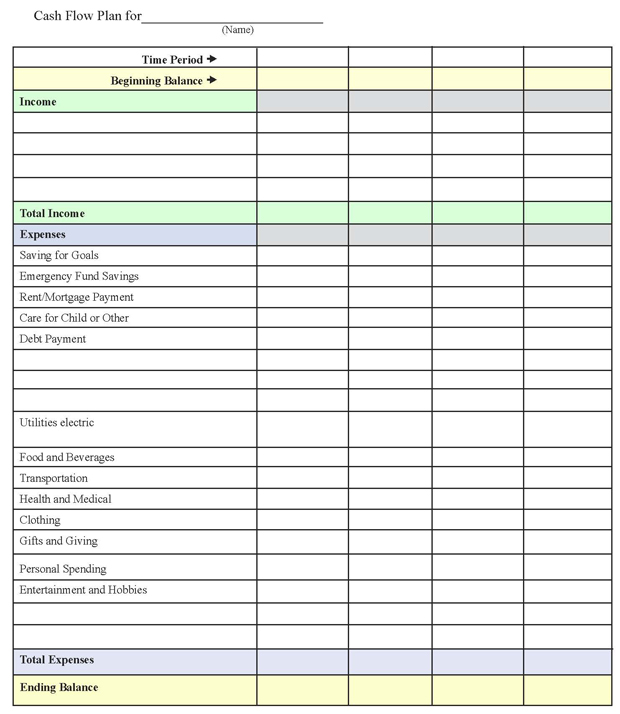

A blank cash flow planning form for you to use to do your own cash flow plan follows the example.

|

|

This publication has been peer reviewed.

Visit the University of Nebraska–Lincoln Extension Publications Web site for more publications.

Index: Financial Management

Money Management

Issued November 2007